While we were planning our strategy leading up to our early retirement in 2012, my husband Rich and I were not too concerned with how to determine whether we had saved enough to last the duration of what we hoped would be a lengthy retirement. My detailed retirement calculator spreadsheet allowed us to model various scenarios that would address that question, based on varying parameters including how much we had saved, at what age we could retire and how much we wanted to spend in retirement.

The bigger, more complicated, and much less discussed issue was how we would structure our savings into an investment portfolio that would easily generate a steady flow of post-retirement income. We were much too young (by multiple decades) to consider an annuity and the traditional strategy of creating a bond ladder (having a series of bonds with staggered maturity dates that freed up cash each year) would not fly given the prolonged and still on-going cycle of dismal bond and GIC rates that pay less than the rate of inflation. Without a company pension or any other source of regular payments such as rental properties, we would need to structure our investment holdings to generate a reliable income stream, which would take some time to set up. More importantly, the payment flow would need to be completed and ready to go before we retired, since we would need to make use of it as soon as we stopped working.

As described in greater detail in our book "Retired at 48 - One Couple's Journey to a Pensionless Retirement", our strategy was to load up on Canadian dividend paying stock, focusing for the most part on blue chip companies with histories of regularly raising their dividends. Our goal was to acquire enough stock to allow us to live off the dividends as our income stream. This defied the common wisdom at the time which advocated to reduce our

equity holdings and acquire a larger percentage of fixed income. We felt less risk in holding stock since we did not care about share price which fluctuates often, but rather the dividend payout which is usually more stable, especially if you select solid companies. Our second decision, that also flouted conventional practices at the time, was to collapse our RRSPs into RRIFs immediately after retirement. This enabled us to spread the source of our retirement income across both registered and non-registered accounts, making all of them last longer. It also helped to reduce the size of our registered accounts slowly over a longer period of time, optimizing our overall tax burden. These days this strategy is regularly recommended by financial advisors and analysts, but at the time when we decided to do it back in 2012, we were definitely going against the tide. Our two strategies have served us well. Over the past 7.5 years since our

retirement, our steady stream of dividend income acts like a bi-weekly pay cheque and has continued to grow at a rate that so far has outpaced the rate of inflation.

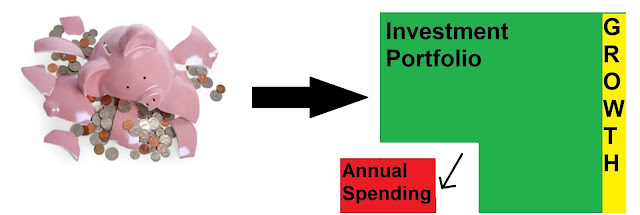

It took many years for us to accumulate a stock portfolio large enough to live off our dividends. I started to consider what our strategy would be like if instead we needed to sell capital annually from our investments in order to fund our retirement. In reading investment columns like the ones in the Globe and Mail, I noticed that the advice given usually went as far as to discuss the order which various money sources (RRIFs, TFSAs, non-registered, cash balances) should be tapped, but did not go into detail on how this actually would work. Giving it some thought, this is what I think I would do:

I started with the assumption that we had still amassed a portfolio consisting of mainly Canadian dividend-paying stocks during our retirement savings period, but that it did not generate enough dividends to support our income needs. Until the returns in the fixed income market improve significantly, we

would still want to hold stock, but

we would need to take steps to reduce risk since now we do care about fluctuating

stock value. Luckily we happen to have a high risk tolerance that allows us to stay calm during large

swings in the market. This is not so for everyone.

With our current strategy of living off our dividends, our investment portfolio is diversified across all of our accounts but not within any particular account. This is because we are not regularly selling stock. We initially withdrew the annual minimum from our RRIF accounts, requesting an equal cash payments monthly. Recently we switched to requesting withdrawal of stock-in-kind from our RRIFs to our shared non-registered account, in order for future dividend income from this stock to be taxed at a more favourable rate.

If instead we were required to sell part of our investment portfolio each year, this would

change how we structured our holdings and withdrawal strategy. In each of our

RRIF accounts, we would re-balance our holdings to increase the number of different stocks that we owned there, covering different sectors in order to have good diversification.

This would

allow us the flexibility each year to pick which stock to sell or not,

depending on whether one sector is performing better than another, or if a

specific company is having an unusually bad year. We would also

consider buying US or Foreign market ETFs in order to maximize

diversification, but I prefer holding Canadian stock as opposed to a

Canadian ETF since we have more control of what we are selling. In choosing which stock to sell, we might pick one that had increased

in value, locking in the capital gain while allowing lesser performing

stock time to recover. Alternately we might cut our losses on a dud

stock that doesn't seem like it would recover any time soon, if ever.

If we had to decide between two equally qualifying stocks, we would keep

the one that had more dividend growth history and potential.

Unless we were in midst of a prolonged market downturn, each year we would sell some stock in each of our RRIF accounts (ensuring to sell enough to cover any withholding tax owed) and make a single withdrawal. The cash from this sale would be supplemented with any dividend income paid from our non-registered accounts, and eventually CPP and OAS payments, to make up our annual income requirements for that year. We would open a special high interest savings account to receive this money so that it continues to earn interest as we spend it throughout the year. We would set up automatic monthly transfers to our bill-paying chequing account to cover the upcoming month's estimated expenses. We use the CDIC-protected EQ Bank which has been paying

2.3 percent annually on its savings accounts for several years now.

This rate currently beats most fixed income offerings as well as the

estimated rate of inflation, and our money is totally liquid as opposed

to being tied up for the specified terms of bonds and GICs. We also get 5 free Interac transactions per month, but that's another story.

In order to have maximum control over when we sell our stock, we would

set standing default instructions with our discount broker to withdraw

the minimum from our RRIFs at the END of the year. These

instructions can be overridden at any time during the year, and allows

an entire year to choose the right time to sell our stock. This means though that our "annual income" savings account needs to have enough cash to support waiting until the end of the year to sell, or else we need to borrow from our long-term emergency funds. Since we would

not be selling all of our shares in any year, we would set up Dividend

Reinvestment Plans (DRIPS) and Dividend Purchase Plans (DPP) for all of the

stock in our RRIF accounts, so that the ones we don't sell for the year

will continue to grow on a compound basis.

We would hold much larger cash balances than we currently do within our long-term emergency fund accounts (currently also at EQ Bank), with enough money to cover at least 2+ years worth of retirement income. This money could be used to temporarily tide us over if we needed to wait out downturns in the stock market and would act as our secure "fixed income" buffer until bond and GIC rates recover enough to be worth purchasing again. At that point, we could once more consider creating a bond or GIC ladder.

At the end of each year, I would analyze the rate of depletion of our investment portfolio against our initial retirement plan to make sure that we were on track and adjust our spending accordingly the following year if we were not. I do this now even with our dividend strategy but it would be so much more important than ever to do if we needed to sell capital annually.

Just thinking through this academic and theoretical situation has been a lot of work and quite stressful since it is clear that the risk involved is much higher than our strategy of living off our dividends while retaining our capital for as long as possible. I'm not sure how viable this plan would be since we are not implementing it, but at least it is a comprehensive plan whereas I fear many people retire with no plan and I wonder what they do then? I am not in any way recommending my hypothetical plan for others, but I guess the message is that you should think about how to generate retirement income ahead of time and implement a plan that suits your needs and risk tolerance (or have your financial advisor do it for you, but hopefully it is more detailed than "You should take $X out of your RRIF each year").

Thursday, October 17, 2019

Wednesday, June 5, 2019

The Quest for US Dividends/Cash

Most of our US stock holdings are kept in our RRIF accounts where dividends are not subject to withholding tax from the IRS. We do have a few shares of AT&T in the US side of our non-registered account and use the dividends paid from this stock to generate US cash that we then withdraw and transfer to our TD Bank US bank account. This is a way for us to accumulate US cash without having to incur currency conversion fees to acquire it. Since we don't own much of the AT&T stock, it takes a while to accumulate enough US cash to cover our expenses while on a vacation in the States. I have often wished that we could generate the US cash at a faster rate.

One step that we took in this endeavour was to move our shares of Algonquin Power (AQN.T) to the US side of our non-registered account, once we realized that this Canadian company actually pays its dividend in US currency. In fact, we were losing money by keeping this stock journaled on the Canadian side, since the US dividends had to be converted back to Canadian currency, for which our discount broker took a fee. So now we have two sources of income from our non-registered account that generates US cash.

Another avenue opened up in 2018 when our discount broker Scotia iTrade finally started to support US fund Registered accounts. In the past within our TFSAs, RRSPs and RRIFs, our stock that paid dividends in US dollars could only be held in our "Canadian" accounts and each of USD payment would be converted back to Canadian dollars by iTrade at a service charge of about 1.5%. Now we can transfer this stock to the US side of our registered accounts and accumulate US cash without incurring conversion fees, just like we did with the AT&T stock in our non-registered account. Accordingly in each of our registered accounts, we moved our US stock plus any Canadian stock that reportedly paid in US dollars. This included Algonquin Power (AQN.T) and Brookfield companies (BIP.UN, BEP.UN). Unfortunately it turns out that Brookfield pays US cash only to US residents, so it did not turn out to be a good source of US currency. However we also held AQN as well as other US stock in our registered accounts, so these were viable sources to generate US cash without incurring currency exchange fees.

But what is involved in withdrawing US cash from a TFSA or RRSP/RRIF account to the US side of the non-registered account? Given that there are rules and limits regarding withdrawing Canadian funds from registered accounts to begin with, what extra complexities are there when trying to withdraw US funds? Would there be any conversion or currency exchange fees? How would any withholding tax be calculated if applicable, and would it be taken from the Canadian or the US side? I decided to make two relatively small experimental withdrawals, one from my TFSA and one from my husband Rich's RRIF to see what happens.

I withdrew $195.02USD that had accumulated in my TFSA and received the full amount in the US side of my non-registered account. There was no conversion charge or any other fees (or taxes as per the feature of the TFSA). This was a relatively easy transaction but a question still remains. When you remove money from your TFSA, you should be able to re-contribute that amount in the next calendar year. But how much will I be able to re-contribute and would this amount be calculated in Canadian? Hopefully the contribution room I generate will not be in US or this will defeat the purpose of trying to extract US cash from my TFSA if I can only replace it with US cash the next year. I am hoping that if for example I withdrew $100 USD when the exchange rate was 1.35, that next year I could re-contribute $135 Canadian.

In preparation for this test, as a baseline I checked my CRA account at the beginning of Jan 2019 prior to making my annual contribution. I expected it to say that my available contribution room is $6000 (the new contribution amount for 2019), since I have maxed out my contributions every year since TFSA started. Instead, it said in large bold characters that I had room to contribute $11,500! Despite having made my 2018 TFSA contribution of $5500 seven months earlier in June of that year, this CRA account was still not up to date. While there is a little icon which when clicked on indicates that all prior contributions may not have been recognized yet, given the lengthy time lag, I find this extremely misleading and wonder what is the point of this account? Someone who is not as cognizant of the limits or kept track of all their deposits and withdrawals through the years may be tricked into over-contributing for the year and then be penalized for it! I continued to check and it was not until late February 2019 that my account reflected my 2018 contribution. This is good to know that there could be almost a full year's lag. So I will not know the answer to how much of the $195.02USD I can re-contribute next year until CRA calculates my contribution room for 2020. I will write about the results in my 2019 Year-End in Review at the beginning of next year.

The second experiment was more complicated since it involved trying to withdraw $284.75USD sitting in my husband Rich's RRIF account. He had already previously made his annual withdrawal, exceeding the minimum by around $11,000 and paid the 20% withholding tax. We have both started to take out more than the minimum in our RRIF accounts to try to actively reduce the size of the accounts before we reach age 71. By moving stock in-kind to our non-registered account, we are also increasing the regular dividend income that we use to pay our bills. We were hoping that the $284.75 cash could be transferred to the US side of our non-registered account and that the withholding tax could be paid from the excess Canadian cash that he had available.

Admittedly, this was an unusual request, but it took three phone calls to Scotia iTrade to try to get this done, and in the end it still was not correct but the result was close enough to what we wanted. In each case, they transferred some US cash to our non-registered account and charged the withholding tax in Canadian dollars, but each time the calculation was incorrect. The first time, they charged insufficient withholding tax, taking only around 11% when Rich was already in the 20% range for the year and left $28.48 USD in the RRIF. The second time they charged the correct 20% withholding tax in Canadian dollars ($76.83), but again only transferred a portion of the US cash, leaving $56.95USD, or the equivalent of the withholding tax in US dollars in the RRIF! Finally after the third call, we were able to get the entire $284.75 USD to be transferred to the non-registered account but now they took around 27% withholding tax ($96.04). This is when we decided that the result was close enough to what we wanted. We were able to extract all of the US cash from our RRIF without any conversion fees, and paid just a bit more than what was required in withholding tax, so we would not be in trouble with CRA. The good news is that there was no currency conversion fee for the transaction. While this was an interesting experiment, the lesson I learned is that this wasn't worth all the trouble.

Next year if we want to withdraw US cash or US stock from a RRIF account, we will be sure to do so while we are still under the yearly minimum limit so that there is no withholding tax in play. After that, we can make further withdrawals in Canadian funds to reduce all the confusion about currency conversion and withholding tax.

Now that we will be accumulating more US currency per quarter from all the additional sources described above, I investigated whether there was a better option for our US bank account in terms of fees, as well as the possibility of getting a no-fee US credit card whose balance could be paid off by that account. Currently we have TD Bank's US $ Daily Interest Chequing Account which has no monthly fees but charges $1.25 per withdrawal if the monthly balance is less than $1500. TD's associated US credit card costs $3.95 US per month. We do not make enough US purchases in a year to make this fee worthwhile for us.

I looked into moving to Royal Bank's US High Interest e-Savings account which has no monthly fees and allows one free debit per month. That in itself would not make it worth our effort to move, since we usually make at most 1-2 withdrawals of US cash per year in order to go on vacation, so the new account would save us at most $1.25-$2.50 on the entire year, and would actually cost more if we ever needed to make two withdrawals in the same month, since RBC's fee for subsequent withdrawals is $3.00. I would also have to go through the hassle of tying my discount broker to this new account and transferring the cash that I already have in TD (at a cost of $1.25). So it would only be worthwhile if I could also obtain RBC's no-fee Visa Signature Black U.S. Credit Card. As it turns out these two products do not go together. In order to get the US Credit Card, I would have to also get a Direct Chequing US Bank Account, which costs $39.50US per year. So we decided to stay with TD US bank account and forgo having a US credit card, which was more of a whim than an necessity anyways.

One step that we took in this endeavour was to move our shares of Algonquin Power (AQN.T) to the US side of our non-registered account, once we realized that this Canadian company actually pays its dividend in US currency. In fact, we were losing money by keeping this stock journaled on the Canadian side, since the US dividends had to be converted back to Canadian currency, for which our discount broker took a fee. So now we have two sources of income from our non-registered account that generates US cash.

Another avenue opened up in 2018 when our discount broker Scotia iTrade finally started to support US fund Registered accounts. In the past within our TFSAs, RRSPs and RRIFs, our stock that paid dividends in US dollars could only be held in our "Canadian" accounts and each of USD payment would be converted back to Canadian dollars by iTrade at a service charge of about 1.5%. Now we can transfer this stock to the US side of our registered accounts and accumulate US cash without incurring conversion fees, just like we did with the AT&T stock in our non-registered account. Accordingly in each of our registered accounts, we moved our US stock plus any Canadian stock that reportedly paid in US dollars. This included Algonquin Power (AQN.T) and Brookfield companies (BIP.UN, BEP.UN). Unfortunately it turns out that Brookfield pays US cash only to US residents, so it did not turn out to be a good source of US currency. However we also held AQN as well as other US stock in our registered accounts, so these were viable sources to generate US cash without incurring currency exchange fees.

But what is involved in withdrawing US cash from a TFSA or RRSP/RRIF account to the US side of the non-registered account? Given that there are rules and limits regarding withdrawing Canadian funds from registered accounts to begin with, what extra complexities are there when trying to withdraw US funds? Would there be any conversion or currency exchange fees? How would any withholding tax be calculated if applicable, and would it be taken from the Canadian or the US side? I decided to make two relatively small experimental withdrawals, one from my TFSA and one from my husband Rich's RRIF to see what happens.

I withdrew $195.02USD that had accumulated in my TFSA and received the full amount in the US side of my non-registered account. There was no conversion charge or any other fees (or taxes as per the feature of the TFSA). This was a relatively easy transaction but a question still remains. When you remove money from your TFSA, you should be able to re-contribute that amount in the next calendar year. But how much will I be able to re-contribute and would this amount be calculated in Canadian? Hopefully the contribution room I generate will not be in US or this will defeat the purpose of trying to extract US cash from my TFSA if I can only replace it with US cash the next year. I am hoping that if for example I withdrew $100 USD when the exchange rate was 1.35, that next year I could re-contribute $135 Canadian.

In preparation for this test, as a baseline I checked my CRA account at the beginning of Jan 2019 prior to making my annual contribution. I expected it to say that my available contribution room is $6000 (the new contribution amount for 2019), since I have maxed out my contributions every year since TFSA started. Instead, it said in large bold characters that I had room to contribute $11,500! Despite having made my 2018 TFSA contribution of $5500 seven months earlier in June of that year, this CRA account was still not up to date. While there is a little icon which when clicked on indicates that all prior contributions may not have been recognized yet, given the lengthy time lag, I find this extremely misleading and wonder what is the point of this account? Someone who is not as cognizant of the limits or kept track of all their deposits and withdrawals through the years may be tricked into over-contributing for the year and then be penalized for it! I continued to check and it was not until late February 2019 that my account reflected my 2018 contribution. This is good to know that there could be almost a full year's lag. So I will not know the answer to how much of the $195.02USD I can re-contribute next year until CRA calculates my contribution room for 2020. I will write about the results in my 2019 Year-End in Review at the beginning of next year.

The second experiment was more complicated since it involved trying to withdraw $284.75USD sitting in my husband Rich's RRIF account. He had already previously made his annual withdrawal, exceeding the minimum by around $11,000 and paid the 20% withholding tax. We have both started to take out more than the minimum in our RRIF accounts to try to actively reduce the size of the accounts before we reach age 71. By moving stock in-kind to our non-registered account, we are also increasing the regular dividend income that we use to pay our bills. We were hoping that the $284.75 cash could be transferred to the US side of our non-registered account and that the withholding tax could be paid from the excess Canadian cash that he had available.

Admittedly, this was an unusual request, but it took three phone calls to Scotia iTrade to try to get this done, and in the end it still was not correct but the result was close enough to what we wanted. In each case, they transferred some US cash to our non-registered account and charged the withholding tax in Canadian dollars, but each time the calculation was incorrect. The first time, they charged insufficient withholding tax, taking only around 11% when Rich was already in the 20% range for the year and left $28.48 USD in the RRIF. The second time they charged the correct 20% withholding tax in Canadian dollars ($76.83), but again only transferred a portion of the US cash, leaving $56.95USD, or the equivalent of the withholding tax in US dollars in the RRIF! Finally after the third call, we were able to get the entire $284.75 USD to be transferred to the non-registered account but now they took around 27% withholding tax ($96.04). This is when we decided that the result was close enough to what we wanted. We were able to extract all of the US cash from our RRIF without any conversion fees, and paid just a bit more than what was required in withholding tax, so we would not be in trouble with CRA. The good news is that there was no currency conversion fee for the transaction. While this was an interesting experiment, the lesson I learned is that this wasn't worth all the trouble.

Next year if we want to withdraw US cash or US stock from a RRIF account, we will be sure to do so while we are still under the yearly minimum limit so that there is no withholding tax in play. After that, we can make further withdrawals in Canadian funds to reduce all the confusion about currency conversion and withholding tax.

Now that we will be accumulating more US currency per quarter from all the additional sources described above, I investigated whether there was a better option for our US bank account in terms of fees, as well as the possibility of getting a no-fee US credit card whose balance could be paid off by that account. Currently we have TD Bank's US $ Daily Interest Chequing Account which has no monthly fees but charges $1.25 per withdrawal if the monthly balance is less than $1500. TD's associated US credit card costs $3.95 US per month. We do not make enough US purchases in a year to make this fee worthwhile for us.

I looked into moving to Royal Bank's US High Interest e-Savings account which has no monthly fees and allows one free debit per month. That in itself would not make it worth our effort to move, since we usually make at most 1-2 withdrawals of US cash per year in order to go on vacation, so the new account would save us at most $1.25-$2.50 on the entire year, and would actually cost more if we ever needed to make two withdrawals in the same month, since RBC's fee for subsequent withdrawals is $3.00. I would also have to go through the hassle of tying my discount broker to this new account and transferring the cash that I already have in TD (at a cost of $1.25). So it would only be worthwhile if I could also obtain RBC's no-fee Visa Signature Black U.S. Credit Card. As it turns out these two products do not go together. In order to get the US Credit Card, I would have to also get a Direct Chequing US Bank Account, which costs $39.50US per year. So we decided to stay with TD US bank account and forgo having a US credit card, which was more of a whim than an necessity anyways.

Wednesday, April 3, 2019

Brookfield Pays US Dividends (But Not for Canadians!)

When my discount broker Scotia iTrade finally added registered US accounts to their repertoire of offerings, I looked to see which of my stocks I could/should move over the US side of my RRIFs and TFSAs. The goal was to receive US cash directly from the companies that paid US dividends without incurring any currency conversion fees. This would apply for stock of companies based on US stock exchanges such as NYSE, as well as for Canadian companies listed on the TSX who happened to pay their dividends in US currency. This would be a great way to accumulate US cash for spending purposes without paying currency exchange rates.

Multiple sources on the internet including a Globe and Mail Investor column, MyOwnAdvisor.ca, CanadianCapitalist.com and DividendEarner.com have listed Canadian companies who pay their dividends in US currency. I happened to own several of them including two Brookfield Asset Management listings (BIP.UN and BEP.UN) and Algonquin Power (AQN.T). Accordingly I requested my discount broker to move the shares of these stocks to the US side of my accounts, thinking that I was saving money on currency conversion. As it turns out, this was only partially correct. Algonquin Power does actually pay its dividends in US dollars and each quarter, I have been receiving the exact amount of US cash that I expected to, based on their posted rate multiplied by the number of shares that I held.

As it turns out, this is NOT the case for Brookfield. Just recently, one of my blog readers kindly pointed out to me that people who had moved their Brookfield shares to the US side of their account were complaining that they were actually losing money! This is because the declared "US dividends" were actually being converted to Canadian when paid to the discount brokers, who then convert them back to US in order to allocate to the US side of their accounts. In all, they were losing 2.5+ percent per transaction! I guess I should have verified this myself when I made the switch, but who knew that so many sources could be wrong? This seemed very confusing to me, so I set out to investigate.

First I confirmed that the assertion was true by finding the latest published quarterly yield for my stock which I then multiplied by the number of shares that I held. For example, I have 353 shares of BEP.UN in the US side of my TFSA account and the rate of payout for March was USD 0.515. Accordingly I expected to be paid $181.80 USD. Instead I was only paid $176.82 with the difference being attributed to conversion fees. The net difference was even larger in my husband's RRIF account where he held significantly more shares of BIP.UN. Next I wanted to understand why this was happening and where the double conversion was taking place.

I looked on the Brookfield Dividend Page and found this disclaimer at the bottom. The first sentence is what probably led to the widespread misunderstanding.

I phoned Scotia iTrade to find out whether it would be possible for me to request Brookfield to pay my dividends in US dollars. What I was told was that Brookfield was not paying me (or any other investor directly). They were paying the discount broker, which is a Canadian corporation and therefore the payouts from Brookfield are in Canadian dollars. So it makes absolutely no sense for me to hold these stocks in the US side of my account, incurring a conversion fee each time a dividend is paid. I asked iTrade to move my Brookfield stock back to the Canadian side of my account, but I worry about all the misinformation that is still out there about Brookfield. I will try to contact some of these websites to make them aware of the situation and ask that Brookfield be removed from the list of "Canadian companies paying US dividends", or at least clarify that they do not pay this to Canadians!

On the other hand, Algonquin Power does pay its dividends in US dollars regardless of whether they are paying a Canadian or American resident. I will now count on it to generate US cash dividends that I can use to spend.

Note: Since posting this blog entry, I have received comments from several people who indicate that they do receive the full US dividend from Brookfield on the US side of their account. BMO Investorline seems to pay out in full and one person even indicated TD Direct Investing, even though I heard that others from TD were charged a currency conversion fee. I haven't figured out what the deciding factor is. I guess the take-away from all this is that you should double-check with your own discount broker. I plan to ask mine why we are being charged a fee at Scotia ITrade while other discount brokers do not.

Multiple sources on the internet including a Globe and Mail Investor column, MyOwnAdvisor.ca, CanadianCapitalist.com and DividendEarner.com have listed Canadian companies who pay their dividends in US currency. I happened to own several of them including two Brookfield Asset Management listings (BIP.UN and BEP.UN) and Algonquin Power (AQN.T). Accordingly I requested my discount broker to move the shares of these stocks to the US side of my accounts, thinking that I was saving money on currency conversion. As it turns out, this was only partially correct. Algonquin Power does actually pay its dividends in US dollars and each quarter, I have been receiving the exact amount of US cash that I expected to, based on their posted rate multiplied by the number of shares that I held.

As it turns out, this is NOT the case for Brookfield. Just recently, one of my blog readers kindly pointed out to me that people who had moved their Brookfield shares to the US side of their account were complaining that they were actually losing money! This is because the declared "US dividends" were actually being converted to Canadian when paid to the discount brokers, who then convert them back to US in order to allocate to the US side of their accounts. In all, they were losing 2.5+ percent per transaction! I guess I should have verified this myself when I made the switch, but who knew that so many sources could be wrong? This seemed very confusing to me, so I set out to investigate.

First I confirmed that the assertion was true by finding the latest published quarterly yield for my stock which I then multiplied by the number of shares that I held. For example, I have 353 shares of BEP.UN in the US side of my TFSA account and the rate of payout for March was USD 0.515. Accordingly I expected to be paid $181.80 USD. Instead I was only paid $176.82 with the difference being attributed to conversion fees. The net difference was even larger in my husband's RRIF account where he held significantly more shares of BIP.UN. Next I wanted to understand why this was happening and where the double conversion was taking place.

I looked on the Brookfield Dividend Page and found this disclaimer at the bottom. The first sentence is what probably led to the widespread misunderstanding.

Please note that the quarterly dividend payable on Brookfield's Class A

Limited Voting Shares is declared in U.S. dollars. Registered

shareholders who are U.S. residents receive their dividends in U.S.

dollars, unless they request the Cdn. dollar equivalent. Registered

shareholders who are Canadian residents receive their dividends in the

Cdn. dollar equivalent, unless they request to receive dividends in U.S.

dollars.

I phoned Scotia iTrade to find out whether it would be possible for me to request Brookfield to pay my dividends in US dollars. What I was told was that Brookfield was not paying me (or any other investor directly). They were paying the discount broker, which is a Canadian corporation and therefore the payouts from Brookfield are in Canadian dollars. So it makes absolutely no sense for me to hold these stocks in the US side of my account, incurring a conversion fee each time a dividend is paid. I asked iTrade to move my Brookfield stock back to the Canadian side of my account, but I worry about all the misinformation that is still out there about Brookfield. I will try to contact some of these websites to make them aware of the situation and ask that Brookfield be removed from the list of "Canadian companies paying US dividends", or at least clarify that they do not pay this to Canadians!

On the other hand, Algonquin Power does pay its dividends in US dollars regardless of whether they are paying a Canadian or American resident. I will now count on it to generate US cash dividends that I can use to spend.

Note: Since posting this blog entry, I have received comments from several people who indicate that they do receive the full US dividend from Brookfield on the US side of their account. BMO Investorline seems to pay out in full and one person even indicated TD Direct Investing, even though I heard that others from TD were charged a currency conversion fee. I haven't figured out what the deciding factor is. I guess the take-away from all this is that you should double-check with your own discount broker. I plan to ask mine why we are being charged a fee at Scotia ITrade while other discount brokers do not.

Wednesday, March 13, 2019

CRA 2018 - Climate Action Incentive and Studio Tax

For provinces including Ontario, Saskatchewan, Manitoba and New Brunswick who chose not to implement their own carbon tax plans, the Federal government intends to levy its own taxes on fuel purchased in those locales. To offset the impact of this, the 2018 CRA tax form has included a Climate Action Incentive, which gives Canadians in these provinces a tax deduction which directly reduces the amount of income tax owed. There seem to be no income claw-back implications so each household is eligible to receive some amount, depending on the family size. An extra amount is provided for small or rural communities. Note that only one taxpayer can claim this incentive on behalf of the household and it probably makes sense for the one with the higher income to do so.

The incentive is supposed to be revenue neutral for the Federal government and compensates for the impending higher fuel charges. This is meant as an appeasement to those against a carbon tax, and the incentive has been offered in advance of that tax being applied. However so far, there has not been much publicity highlighting this incentive, and even less information about how you actually go about claiming it on your tax form. As an appeasement tactic for the Federal government, not touting this far and wide seems counterproductive?

After some searching on the internet, my husband and I found that you need to fill out Schedule 14 and the resultant deduction will appear on Line 449 of the Credits section (page 4) of your income tax form. I chose to apply the deduction to my taxes. For years now, we have used the free income tax program StudioTax in order to enter our tax information and to NETFILE. Once we figured out which schedule to fill out, it was a simple matter of finding that form on StudioTax and filling out the few fields relevant to us.

The program automatically applied the applicable deduction to line 449 and the amount of my taxes owed was reduced accordingly. I assume that anyone filling out a paper form would need to fill out Schedule 14 as well as enter the result in line 449.

More information can be found here:

https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/5006-s14/5006-s14-18e.pdf

The incentive is supposed to be revenue neutral for the Federal government and compensates for the impending higher fuel charges. This is meant as an appeasement to those against a carbon tax, and the incentive has been offered in advance of that tax being applied. However so far, there has not been much publicity highlighting this incentive, and even less information about how you actually go about claiming it on your tax form. As an appeasement tactic for the Federal government, not touting this far and wide seems counterproductive?

After some searching on the internet, my husband and I found that you need to fill out Schedule 14 and the resultant deduction will appear on Line 449 of the Credits section (page 4) of your income tax form. I chose to apply the deduction to my taxes. For years now, we have used the free income tax program StudioTax in order to enter our tax information and to NETFILE. Once we figured out which schedule to fill out, it was a simple matter of finding that form on StudioTax and filling out the few fields relevant to us.

The program automatically applied the applicable deduction to line 449 and the amount of my taxes owed was reduced accordingly. I assume that anyone filling out a paper form would need to fill out Schedule 14 as well as enter the result in line 449.

More information can be found here:

https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/5006-s14/5006-s14-18e.pdf

Saturday, January 5, 2019

Year End Review 2018: After Six Full Years of Retirement

It has been 6.5 years since my husband Rich and I retired together at age 48 and the time seems to have gone by in a flash. Reflecting on this past year, 2018 certainly was a wild and turbulent time for the stock market. The S&P/TSX Composite Index went through a roller coaster ride, starting off at a 10-year high with a value of just under 16413. After such a long bull run and with all the economic and social-political turmoil happening around the world, it is not surprising that the markets were due for a fall. By the second week of February, the index fell 8% to 15034 but surprisingly by mid July, it had rallied to be even slightly higher than its year-beginning value. Unfortunately it was pretty much downhill from there, as the index went on a downward spiral, falling to its lowest point on Christmas Eve with an index of 13780. The index was16% below its starting value before rallying slightly and closing the year with a final value of almost 14323, down 12.7%. It is too bad there is not a way to predict the timing of the rise and fall of the stock market, in order to take advantage of the adage to buy low and sell high. In early February, as part of an effort to re-balance our portfolio, I decided to sell some of the shares of Premium Brand (PBH) in my LIRA for $106/share. This would reduce the total value of that holding and lock in some of the profits made. The shares had risen rapidly in price since I first bought them in October 2016 for $60/share. I regretted the sale when the stock price continued to rise to over $120 through April, but then unexpectedly, the price started to plummet. By the end of 2018, PBH was going for around $75/share and my earlier transaction seemed prescient, when it was actually just dumb luck.

Our portfolio followed a similar trend to the TSX and ended the year down 10% from our opening balance. But because of our strategy to hold Canadian eligible dividend paying stocks long-term while living off our dividends, we were not really affected by the volatility. While the value of our portfolio took a dive along with the rest of the market, the total dividends generated by our stocks increased by 5%, with the majority of the companies that we hold raising their payout at least once in the year. Since we first started living off our dividends when we retired in 2012, our total payout has increased over 45% despite a few duds decreasing or eliminating their dividends. When the market eventually recovers, I will look at the feasibility of selling the few stocks that we own which have not raised their dividends for multiple years. This is assuming that I can find replacements that have a better history of raising dividends, but which will still maintain our diversification and dividend yield requirements. We actually see the downturn in the markets as an advantage since it allows us to use the Dividend Reinvestment Plan (DRIP) to purchase more shares at a lower price. We apply the DRIP to companies that we would like to grow, in accounts where we are not using the dividends paid as immediate income.

As part of our annual year-end review, I took a look at the distribution of our various stock holdings and the dividends that they generate in terms of market capitalization and market sectors. We want to ensure that our holdings are skewed more towards the stability of large and mid cap stocks as opposed to small cap, and that we are well diversified across multiple sectors. This year, our small cap percentage increased, not so much because we bought more stock from smaller companies, but because some of our mid cap stocks lost so much in value that they became small cap.

Despite our goal to buy and hold most of our stock, 2018 marked an unusually active trading year where we lost our holdings in some companies through forced buy-backs, mergers and acquisitions. In some cases, it was a welcome and beneficial change while in others, it was not what we would have preferred to have happened since it led to a loss of a steady dividend income stream that we would now need to find a replacement for. The CEO of HNZ Group bought back all of the shares of his company at a price of $18.70/share, which left us with a capital loss of around $7K but gave us a much higher share price than the market price. Enbridge (ENB) merged with its subsidiary Enbridge Income Fund (ENF), providing Enbridge shares to replace the ENF shares. Royal Bank (RY) called back its preferred shares RY.PR.D and paid out its value in cash. This was actually a blessing for us since we regretted buying the preferred shares but there was not much of a market to sell them. The preferred shares gave us a good yield of 4.5% at the time of purchase and promised a more stable share price. But the dividend was fixed while Royal Bank raised its yield twice annually over the same period. We would have been better off to just buy and hold more Royal Bank. In each case where we received cash for the buybacks, we purchased more dividend paying stock. I chose Emera (EMA) and Bank of Montreal (BMO), both with long-standing histories of raising dividends.

An interesting situation arose when it was announced that Brookfield Infrastructure (BIP.UN) would purchase Enercare Inc. (ECI) in a friendly takeover. We own both of these stocks, holding Enercare in both a registered and a non-registered account and Brookfield only in a registered account. Our first decision was whether to accept cash or Brookfield shares for the transaction. While I would want more BIP.UN in my registered account, I do not want it in our non-registered account because it is a limited partnership that pays return of capital instead of dividends, which leads to accounting and tax complications if not sheltered in a registered account. By the time I made my decision to take shares in the registered account, it was too late to make the request, so I ended up with cash in both cases.

The next issue to deal with was the $18,000 capital gain that would be triggered in our non-registered account from this forced "sale" of our ECI stock. We already had a $7K loss from the HNZ transaction to partially offset the gain, but still needed a further loss of $11K to offset the whole amount. At the beginning of the year, we assessed the major "paper loss" that we held in our Corus (CJR.B) stock when its price plummeted to less than 20% of our purchase price. We decided that since we would lose so much of our initial investment, it was not worth selling even though they planned to cut their dividend later in the year. We would not recover enough money to buy much of anything else so our best bet was to hold, gather the measly remaining dividends and hope for an eventual rebound or a buyout like HNZ which might artificially inflate the sale price. But now that I needed a loss to cover the ECI gain, it seemed the perfect time to dump some of my Corus stock, which I did.

Like Corus, I had a similar decision to make with my Cominar REIT (CUF.UN) stock, which I held in my RRIF account. After years of paying out a fairly decent dividend, Cominar cut their dividend slightly in 2017 and then more significantly in 2018. I should have cut and run last year but inertia and the hope of recovery prevailed. Now belatedly, it was time to take action and unlike Corus, I would still recover over 67% of my initial investment which was enough to buy a replacement stock. With the cash generated from the sale, I purchased Manulife Financial (MFC) which yields a healthy 5% and has raised its dividend annually for at least the past 5 years.

In last year's blog, I wrote about changing our RRIF withdrawal strategy from taking a monthly cash payout to making a stock withdrawal "in-kind" at the beginning of the year. The goal is to gradually move dividend income from being taxed at 100% in the RRIF to generating Canadian eligible dividend income in our non-registered account which is taxed at a much more lenient rate. We would also be reducing the values of our RRIFs at a faster rate since we are removing both the capital and the income it generated. Finally by taking our RRIF payments as stock in kind, it reduced the amount of cash that we needed to save up in those accounts, and therefore allowed us to DRIP some of our stocks.

My second goal was to smooth out the monthly dividend income being generated from our non-registered account so that each month would pay enough to cover regular expenses. Abnormal or unexpected expenses would require dipping into the cash reserves that we held in our short and long-term "kitties". Since the dividends paid out in the second month of each quarter were relatively meager, I deliberately withdrew stock from our RRIF accounts that paid out in that month. While I made good inroads last year, I am happy to report that at the end of 2018, this second goal has been fully accomplished. For 2019, I no longer need to worry about this requirement when selecting which stocks we withdraw for our annual RRIF payments.

In late 2018, I turned 55 which is a milestone year in terms of our retirement, expense and investing strategies. I now qualify for a few early seniors discounts including 20% off on Tuesdays at Rexall Pharmacy and 10% off at Best Western. While the medical emergency travel insurance that I usually purchase from Manulife costs a few dollars more after turning 55, at least I still don't need to fill out a medical questionnaire to qualify. This is not required until age 60. I also confirmed that I still qualify for the 15 day travel insurance that comes with our Visa infinite Dividend credit card. This ends at age 65.

Our portfolio followed a similar trend to the TSX and ended the year down 10% from our opening balance. But because of our strategy to hold Canadian eligible dividend paying stocks long-term while living off our dividends, we were not really affected by the volatility. While the value of our portfolio took a dive along with the rest of the market, the total dividends generated by our stocks increased by 5%, with the majority of the companies that we hold raising their payout at least once in the year. Since we first started living off our dividends when we retired in 2012, our total payout has increased over 45% despite a few duds decreasing or eliminating their dividends. When the market eventually recovers, I will look at the feasibility of selling the few stocks that we own which have not raised their dividends for multiple years. This is assuming that I can find replacements that have a better history of raising dividends, but which will still maintain our diversification and dividend yield requirements. We actually see the downturn in the markets as an advantage since it allows us to use the Dividend Reinvestment Plan (DRIP) to purchase more shares at a lower price. We apply the DRIP to companies that we would like to grow, in accounts where we are not using the dividends paid as immediate income.

As part of our annual year-end review, I took a look at the distribution of our various stock holdings and the dividends that they generate in terms of market capitalization and market sectors. We want to ensure that our holdings are skewed more towards the stability of large and mid cap stocks as opposed to small cap, and that we are well diversified across multiple sectors. This year, our small cap percentage increased, not so much because we bought more stock from smaller companies, but because some of our mid cap stocks lost so much in value that they became small cap.

Despite our goal to buy and hold most of our stock, 2018 marked an unusually active trading year where we lost our holdings in some companies through forced buy-backs, mergers and acquisitions. In some cases, it was a welcome and beneficial change while in others, it was not what we would have preferred to have happened since it led to a loss of a steady dividend income stream that we would now need to find a replacement for. The CEO of HNZ Group bought back all of the shares of his company at a price of $18.70/share, which left us with a capital loss of around $7K but gave us a much higher share price than the market price. Enbridge (ENB) merged with its subsidiary Enbridge Income Fund (ENF), providing Enbridge shares to replace the ENF shares. Royal Bank (RY) called back its preferred shares RY.PR.D and paid out its value in cash. This was actually a blessing for us since we regretted buying the preferred shares but there was not much of a market to sell them. The preferred shares gave us a good yield of 4.5% at the time of purchase and promised a more stable share price. But the dividend was fixed while Royal Bank raised its yield twice annually over the same period. We would have been better off to just buy and hold more Royal Bank. In each case where we received cash for the buybacks, we purchased more dividend paying stock. I chose Emera (EMA) and Bank of Montreal (BMO), both with long-standing histories of raising dividends.

An interesting situation arose when it was announced that Brookfield Infrastructure (BIP.UN) would purchase Enercare Inc. (ECI) in a friendly takeover. We own both of these stocks, holding Enercare in both a registered and a non-registered account and Brookfield only in a registered account. Our first decision was whether to accept cash or Brookfield shares for the transaction. While I would want more BIP.UN in my registered account, I do not want it in our non-registered account because it is a limited partnership that pays return of capital instead of dividends, which leads to accounting and tax complications if not sheltered in a registered account. By the time I made my decision to take shares in the registered account, it was too late to make the request, so I ended up with cash in both cases.

The next issue to deal with was the $18,000 capital gain that would be triggered in our non-registered account from this forced "sale" of our ECI stock. We already had a $7K loss from the HNZ transaction to partially offset the gain, but still needed a further loss of $11K to offset the whole amount. At the beginning of the year, we assessed the major "paper loss" that we held in our Corus (CJR.B) stock when its price plummeted to less than 20% of our purchase price. We decided that since we would lose so much of our initial investment, it was not worth selling even though they planned to cut their dividend later in the year. We would not recover enough money to buy much of anything else so our best bet was to hold, gather the measly remaining dividends and hope for an eventual rebound or a buyout like HNZ which might artificially inflate the sale price. But now that I needed a loss to cover the ECI gain, it seemed the perfect time to dump some of my Corus stock, which I did.

Like Corus, I had a similar decision to make with my Cominar REIT (CUF.UN) stock, which I held in my RRIF account. After years of paying out a fairly decent dividend, Cominar cut their dividend slightly in 2017 and then more significantly in 2018. I should have cut and run last year but inertia and the hope of recovery prevailed. Now belatedly, it was time to take action and unlike Corus, I would still recover over 67% of my initial investment which was enough to buy a replacement stock. With the cash generated from the sale, I purchased Manulife Financial (MFC) which yields a healthy 5% and has raised its dividend annually for at least the past 5 years.

In last year's blog, I wrote about changing our RRIF withdrawal strategy from taking a monthly cash payout to making a stock withdrawal "in-kind" at the beginning of the year. The goal is to gradually move dividend income from being taxed at 100% in the RRIF to generating Canadian eligible dividend income in our non-registered account which is taxed at a much more lenient rate. We would also be reducing the values of our RRIFs at a faster rate since we are removing both the capital and the income it generated. Finally by taking our RRIF payments as stock in kind, it reduced the amount of cash that we needed to save up in those accounts, and therefore allowed us to DRIP some of our stocks.

My second goal was to smooth out the monthly dividend income being generated from our non-registered account so that each month would pay enough to cover regular expenses. Abnormal or unexpected expenses would require dipping into the cash reserves that we held in our short and long-term "kitties". Since the dividends paid out in the second month of each quarter were relatively meager, I deliberately withdrew stock from our RRIF accounts that paid out in that month. While I made good inroads last year, I am happy to report that at the end of 2018, this second goal has been fully accomplished. For 2019, I no longer need to worry about this requirement when selecting which stocks we withdraw for our annual RRIF payments.

In late 2018, I turned 55 which is a milestone year in terms of our retirement, expense and investing strategies. I now qualify for a few early seniors discounts including 20% off on Tuesdays at Rexall Pharmacy and 10% off at Best Western. While the medical emergency travel insurance that I usually purchase from Manulife costs a few dollars more after turning 55, at least I still don't need to fill out a medical questionnaire to qualify. This is not required until age 60. I also confirmed that I still qualify for the 15 day travel insurance that comes with our Visa infinite Dividend credit card. This ends at age 65.

Most significantly, turning

55 meant I could finally start collecting income from my locked-in

defined contribution work pension plan, which I moved into a self-directed locked-in

retirement account (LIRA) at the time of my retirement at age 48. While we were able to convert our RRSPs into RRIFs immediately after retiring and have been

receiving annual income from these accounts ever since, our LIRAs were not available for conversion into Life Income Funds (LIFs) until age 55. In addition to the age requirement, the LIF is much more restrictive than a RRIF in that you are required to withdraw an annual amount that falls between both a minimum and a maximum. The limit on how much you can withdraw each year is designed so that the income in the LIF lasts until age 90. These paternalistic controls on my hard-earned employment retirement savings felt galling to me, so I was happy to learn about a relatively obscure rule that allows me to request that 50% of my LIF be freed either as cash or as a one time tax-free deposit into my RRIF account. The catch is that you must submit the form within 60 days of the LIF account becoming active, or else you lose this right forever after!! Information about this rule can be found on the Financial Services Commission of Ontario website and the request form can be found at https://www.fsco.gov.on.ca/en/pensions/Forms/Documents/C-1204E.2.pdf.

On the day of my birthday, I called the sales department of my discount broker Scotia iTrade in order to open a locked-in Life Income Fund (LIF). They were able to fill in most of the form for me over the phone and then emailed it to me to print and sign. I dropped off the signed form at my local Scotiabank branch and within a few days, my LIF account was open. I then proceeded to wait and wait for the money to be transferred from my LIRA to my LIF. What I was not informed until I enquired a week later was that I had to send them a written "letter of instruction" before this would happen. It was not automatic as I initially assumed and this delay almost derailed my timing for processing the form to free 50% of my LIF.

In the meantime, I scheduled an in-person meeting with a representative at the Scotia iTrade sales office in order to execute the directive to free the 50% of the LIF. I chose to move the money into my RRIF as opposed to taking a lump sum cash amount, in order to prevent a major tax hit on my 2018 taxable income. This way, I will be taxed on the LIF withdrawal but will be assigned a deduction for the same amount, resulting in no tax being paid on the transfer. I printed off the form and filled out most of the fields prior to the meeting. Part III and Part IV of the form required signatures in front of an impartial witness, which the iTrade sales rep was able to act as. I found out from a friend who had a federally regulated pension plan that he required a Public Notary or Commissioner to be the witness. Luckily this was not the case for my provincially regulated LIF. Noting that Part IV required signed approval from my spouse, I brought my husband with me to the meeting so that he could sign in front of the witness.

I requested to transfer 50% of the value of my LIF into my RRIF as stock in kind. Prior to the meeting, I spent some time analyzing the stock in my LIF to see which companies and how many shares I could move in order to come close to 50% of the value of the LIF. Because I could not predict the stock prices on the day of the transfer, I requested a bit less than the 50% value and made sure that I had accumulated enough cash to make up the difference. I instructed the rep to use the lowest stock price of the day, so that I could free up more shares. As of this year (2019), I will need to start my annual withdrawal from my LIF and will again request to withdraw stock in-kind. At age 55, my minimum withdrawal is 2.86% and the maximum is 6.5%. Unlike the RRIF, I cannot use my spouse's age to set the withdrawal percentages. Now that I have gone the entire process of converting my LIRA to a LIF and freeing 50%, my husband will be ready to do the same when he turns 55 later this year. Since his work pension amount is less, after the 50% withdrawal he may soon qualify to unlock the entire remaining value of the LIF under the "Small Amount" rule. See Question 9 of the LIF FAQs.

Several years after RBC and TD Banks first introduced them, my discount broker Scotia iTrade has finally followed suit and now offers U.S. registered accounts for RRSPs, RRIFs, LIRAs, LIFs and TFSAs. Within these accounts, you can hold American stocks or Canadian stocks such as Algonquin Power (AQN.T) and Brookfield (e.g. BIP.UN, BEP.UN) that pay dividends in U.S. Dollars and keep the U.S. cash rather than having the dividends converted to Canadian and incurring currency exchange and extra fees charged by the brokerage. It has been estimated that the savings on these fees could amount to as much as 1.5% of the value of the dividends for each payout. I have now moved the applicable stocks in our portfolio to the US side in both our registered and non-registered accounts. For our non-registered account, I have been transferring any US cash dividends to my US bank account, thus generating a source of US funds to spend on our trips to the United States without having to pay currency conversion rates. I am not sure yet whether I can withdraw US cash from the US side of my TFSA account directly to the US side of my non-registered account without the money being converted to/from Canadian. If this is possible, then I assume that I can then re-contribute the Canadian value of that withdrawal amount the next calendar year? I will try this with a small amount later on in the year. Similarly I have not tried to withdraw US stocks in kind as part of my annual RRIF withdrawal. This might be an experiment for a future year.

In 2018, we made some major changes to our utility expenses. Finally deciding to get with the times, we purchased a second cell phone so that we each had one and cancelled our phone land line. In addition to the cost savings of the phone line, we had the extra intangible advantage of getting rid of the telemarketers and donation seekers who were basically the only ones calling our land line. We now obsessively protect our cell phone numbers and only provide them to companies or institutions that we actually want or need to call us. We were lucky enough to be able to take advantage of the brief price war that the major Tel-coms waged this year and snagged the deal of 10GB of data for $60/month from Bell Canada. In fact, my husband signed up for the cell service deal before we even bought the second phone. We renegotiated a cheaper price with Rogers for our internet and cable bill after our previous discounted deal expired but it was only for one year so I think we will need to try and do so again this year.

For the first time since 2014, we were not able to secure a home swap for our vacation. We still had a lovely 3 week "Off The Beaten Path" trip to London, England in May, but it was quite the sticker-shock when we had to pay for our own accommodations for the first time in years. We also took an overnight cycling vacation to Meaford, Ontario (near Collingwood) in July and an impromptu, last-minute 2 night/3 days stay in Manhattan in November which I am busy trying to blog about. Unfortunately once again, I have not been able to finish writing about our vacations within the year that we took them. We continue to enjoy tennis, cycling, walking, theatre, art galleries and taking interest courses. I have been trying to complete a free online course on Greek Mythology for over half a year now, but keep getting distracted by other activities and social events. Our early retirement continues to be wonderful, active, fulfilling, stress-free and was worth all the saving and planning over the years that made it possible.

References:

2017 Year End Review

2016 Year End Review

2015 Year End Review

2014 Year End Review

2013 Year End Review

Get our Retirement Planning Spreadsheets

Buy Retired at 48 - One Couple's Journey to a Pensionless Retirement

On the day of my birthday, I called the sales department of my discount broker Scotia iTrade in order to open a locked-in Life Income Fund (LIF). They were able to fill in most of the form for me over the phone and then emailed it to me to print and sign. I dropped off the signed form at my local Scotiabank branch and within a few days, my LIF account was open. I then proceeded to wait and wait for the money to be transferred from my LIRA to my LIF. What I was not informed until I enquired a week later was that I had to send them a written "letter of instruction" before this would happen. It was not automatic as I initially assumed and this delay almost derailed my timing for processing the form to free 50% of my LIF.

In the meantime, I scheduled an in-person meeting with a representative at the Scotia iTrade sales office in order to execute the directive to free the 50% of the LIF. I chose to move the money into my RRIF as opposed to taking a lump sum cash amount, in order to prevent a major tax hit on my 2018 taxable income. This way, I will be taxed on the LIF withdrawal but will be assigned a deduction for the same amount, resulting in no tax being paid on the transfer. I printed off the form and filled out most of the fields prior to the meeting. Part III and Part IV of the form required signatures in front of an impartial witness, which the iTrade sales rep was able to act as. I found out from a friend who had a federally regulated pension plan that he required a Public Notary or Commissioner to be the witness. Luckily this was not the case for my provincially regulated LIF. Noting that Part IV required signed approval from my spouse, I brought my husband with me to the meeting so that he could sign in front of the witness.

I requested to transfer 50% of the value of my LIF into my RRIF as stock in kind. Prior to the meeting, I spent some time analyzing the stock in my LIF to see which companies and how many shares I could move in order to come close to 50% of the value of the LIF. Because I could not predict the stock prices on the day of the transfer, I requested a bit less than the 50% value and made sure that I had accumulated enough cash to make up the difference. I instructed the rep to use the lowest stock price of the day, so that I could free up more shares. As of this year (2019), I will need to start my annual withdrawal from my LIF and will again request to withdraw stock in-kind. At age 55, my minimum withdrawal is 2.86% and the maximum is 6.5%. Unlike the RRIF, I cannot use my spouse's age to set the withdrawal percentages. Now that I have gone the entire process of converting my LIRA to a LIF and freeing 50%, my husband will be ready to do the same when he turns 55 later this year. Since his work pension amount is less, after the 50% withdrawal he may soon qualify to unlock the entire remaining value of the LIF under the "Small Amount" rule. See Question 9 of the LIF FAQs.

Several years after RBC and TD Banks first introduced them, my discount broker Scotia iTrade has finally followed suit and now offers U.S. registered accounts for RRSPs, RRIFs, LIRAs, LIFs and TFSAs. Within these accounts, you can hold American stocks or Canadian stocks such as Algonquin Power (AQN.T) and Brookfield (e.g. BIP.UN, BEP.UN) that pay dividends in U.S. Dollars and keep the U.S. cash rather than having the dividends converted to Canadian and incurring currency exchange and extra fees charged by the brokerage. It has been estimated that the savings on these fees could amount to as much as 1.5% of the value of the dividends for each payout. I have now moved the applicable stocks in our portfolio to the US side in both our registered and non-registered accounts. For our non-registered account, I have been transferring any US cash dividends to my US bank account, thus generating a source of US funds to spend on our trips to the United States without having to pay currency conversion rates. I am not sure yet whether I can withdraw US cash from the US side of my TFSA account directly to the US side of my non-registered account without the money being converted to/from Canadian. If this is possible, then I assume that I can then re-contribute the Canadian value of that withdrawal amount the next calendar year? I will try this with a small amount later on in the year. Similarly I have not tried to withdraw US stocks in kind as part of my annual RRIF withdrawal. This might be an experiment for a future year.

In 2018, we made some major changes to our utility expenses. Finally deciding to get with the times, we purchased a second cell phone so that we each had one and cancelled our phone land line. In addition to the cost savings of the phone line, we had the extra intangible advantage of getting rid of the telemarketers and donation seekers who were basically the only ones calling our land line. We now obsessively protect our cell phone numbers and only provide them to companies or institutions that we actually want or need to call us. We were lucky enough to be able to take advantage of the brief price war that the major Tel-coms waged this year and snagged the deal of 10GB of data for $60/month from Bell Canada. In fact, my husband signed up for the cell service deal before we even bought the second phone. We renegotiated a cheaper price with Rogers for our internet and cable bill after our previous discounted deal expired but it was only for one year so I think we will need to try and do so again this year.

For the first time since 2014, we were not able to secure a home swap for our vacation. We still had a lovely 3 week "Off The Beaten Path" trip to London, England in May, but it was quite the sticker-shock when we had to pay for our own accommodations for the first time in years. We also took an overnight cycling vacation to Meaford, Ontario (near Collingwood) in July and an impromptu, last-minute 2 night/3 days stay in Manhattan in November which I am busy trying to blog about. Unfortunately once again, I have not been able to finish writing about our vacations within the year that we took them. We continue to enjoy tennis, cycling, walking, theatre, art galleries and taking interest courses. I have been trying to complete a free online course on Greek Mythology for over half a year now, but keep getting distracted by other activities and social events. Our early retirement continues to be wonderful, active, fulfilling, stress-free and was worth all the saving and planning over the years that made it possible.

References:

2017 Year End Review

2016 Year End Review

2015 Year End Review

2014 Year End Review

2013 Year End Review

Get our Retirement Planning Spreadsheets

Buy Retired at 48 - One Couple's Journey to a Pensionless Retirement

Subscribe to:

Comments (Atom)